Ever held a check in your hand and thought: “Which number is my account? Which one is the routing number?” You’re not alone. If you’re new to checks, those strings of digits at the bottom can be confusing.

Don’t worry — in this guide, we’ll walk you through exactly what each number means, why it matters, and how to find it quickly. By the end, you’ll never mix them up again.

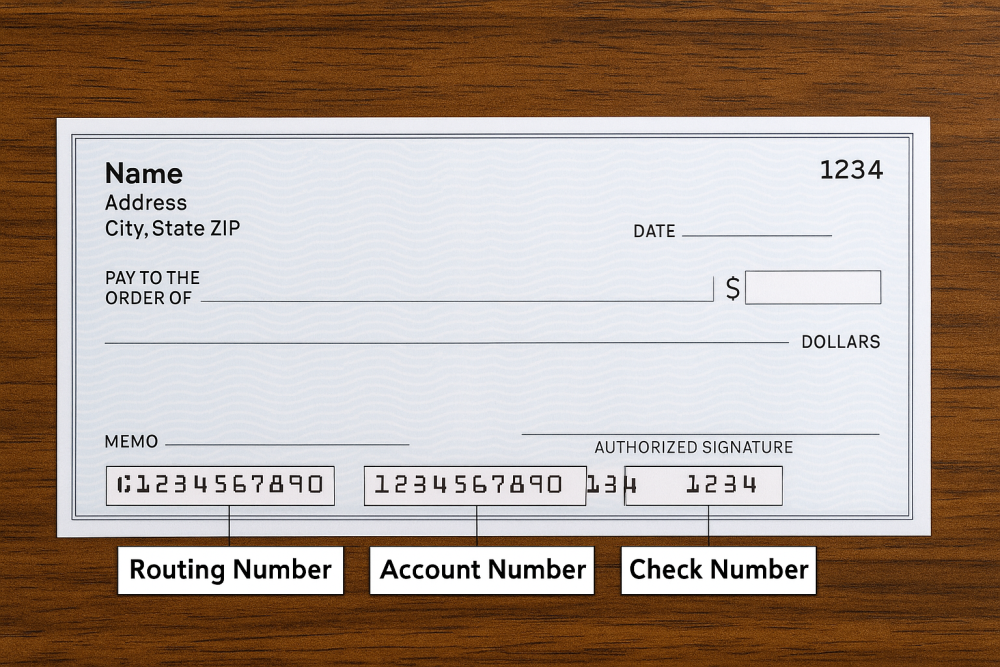

The Three Key Numbers on Every Check

1. Routing Number

This is the nine-digit code on the far left of the check.

Why it matters:

- Identifies the bank where your account is held.

- Required for direct deposit (your paycheck going straight to your account).

- Used when setting up auto bill pay.

- Needed for ACH transfers (electronic payments).

Important: Some banks use a different routing number for wire transfers. Always confirm with your bank before sending money.

2. Account Number

This comes right after the routing number, usually in the middle of the line.

Key facts:

- Length varies (8–12 digits depending on the bank).

- It’s your personal bank ID — unique to you.

- Do not confuse it with your debit or credit card number.

What it’s used for:

- Getting direct deposits.

- Paying bills.

- Setting up transfers or auto-payments.

Think of it like your house number, while the routing number is the street address.

3. Check Number

This one is less about moving money and more about record keeping.

- Appears in two places: upper-right corner and at the far right of the bottom line.

- Helps you (and the bank) track which check was used.

- Useful for balancing your checkbook and preventing confusion.

Visual Guide

On a standard U.S. personal check, the bottom row reads from left to right:

- Routing number (9 digits) — your bank’s ID.

- Account number — your unique account.

- Check number — matches the one in the top corner.

(Insert an infographic or labeled image here to make it crystal clear.)

What If You Don’t Have a Check?

- Online banking: Log into your bank’s website.

- Mobile app: Most banks show your routing and account number in the app.

- Call your bank: A customer service rep can confirm.

If the numbers on your check are smudged or unreadable, order a new checkbook or request the details directly from your bank.

Do All Checks Look the Same?

Not exactly.

- Business checks may have a slightly different layout.

- Credit union checks can look different too, but routing numbers are almost always first.

Security Tips

- Keep your checks in a safe place.

- Never post a picture of a check online.

- Share account details only with trusted companies or employers.

- Regularly monitor your account for unusual activity.

Remember:

- Your routing number is public (anyone can look it up).

- Your account number is private — protect it.

FAQ

Is the routing number always first?

Yes, in nearly all cases.

Can I use the same routing number for wire transfers?

Not always. Many banks have a separate number for wires.

What if I don’t have a check?

You can find your numbers in online or mobile banking.

What’s the difference between account number and card number?

Your account number identifies your bank account; your card number identifies your debit/credit card. They’re not the same.

Final Thoughts

Now you know exactly where to find the routing number, account number, and check number on a check — and why each one matters. Save a labeled example or this guide for quick reference next time you need to set up direct deposit or pay bills.

Written by Dmitriy Ivanenko, financial literacy writer for the “Finances Planning” section.

References: